Best budget planner for couples Managing money as a couple can be challenging. That’s why a good budget planner is essential.

Every couple wants to achieve financial harmony. Whether you are newlyweds or have been together for years, managing your finances together is crucial. A budget planner helps you track expenses, set savings goals, and plan for future needs. It encourages open communication about money, reducing stress and misunderstandings.

With the right budget planner, couples can work together to build a secure and prosperous future. This guide will help you find the best budget planner tailored for couples. Let’s get started and make financial planning a breeze.

Credit: worksheets.clipart-library.com

Importance Of Budgeting For Couples

Budgeting is crucial for couples. It helps manage finances effectively and prevents misunderstandings. A budget planner can be a valuable tool. It ensures both partners are on the same page.

Benefits Of Joint Budgeting

Joint budgeting helps couples align their financial goals. It promotes teamwork and strengthens relationships. Sharing financial responsibilities can reduce stress. It makes money management more efficient. Couples can plan for future expenses together. This fosters a sense of security and trust.

Avoiding Financial Conflicts

Money issues often cause conflicts in relationships. A budget planner can help avoid these problems. It provides transparency in spending. Both partners can track expenses and income. This reduces misunderstandings and arguments about money. Clear communication about finances is essential. It ensures both partners feel heard and valued.

Setting Financial Goals Together

Setting financial goals together can strengthen your relationship. It ensures both partners are on the same page. Couples can plan their future effectively. This approach helps in reducing financial stress. It also promotes teamwork and mutual understanding.

Short-term Goals

Short-term goals are important for immediate needs. These goals can include saving for a vacation, paying off small debts, or building an emergency fund. Couples should list their priorities. Then, they can allocate funds accordingly. Keeping track of these goals can boost confidence. Achieving them can be rewarding and motivating.

Long-term Goals

Long-term goals require more planning and commitment. These goals may include buying a house, saving for retirement, or funding children’s education. Couples need to discuss their dreams and aspirations. Setting clear, realistic goals is essential. Regular reviews can help in staying on track. Adjustments may be needed along the way. This ensures both partners remain aligned with their financial objectives.

Choosing The Right Budget Planner

Finding the perfect budget planner for couples can feel like a daunting task. With so many options available, it’s important to choose one that suits your needs and preferences. Let’s dive into the factors you should consider and explore some top budget planner options to help you manage your finances together seamlessly.

Factors To Consider

When choosing a budget planner, it’s crucial to consider your financial goals. Are you saving for a house, a vacation, or just trying to manage day-to-day expenses? Think about your preferred format. Do you like paper planners, digital apps, or a combination of both? Consider the planner’s layout and ease of use. A good planner should be intuitive and straightforward. Reflect on your communication style. Some planners include prompts and spaces for discussions, ensuring both partners are on the same page.

Top Budget Planner Options

There are several excellent budget planners designed for couples. Here are some standout options:

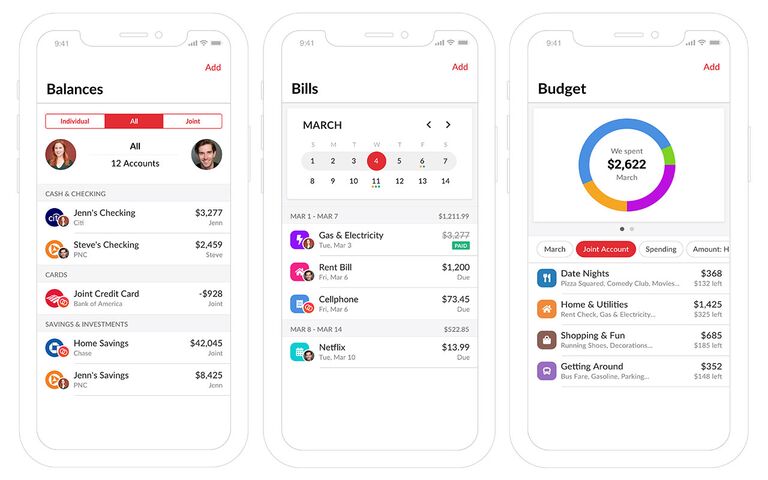

- Honeydue: A free app that lets you sync accounts, track expenses, and chat about finances. Ideal for tech-savvy couples.

- Monarch Money: This app offers personalized advice and budget tracking. Great for couples who appreciate detailed financial insights.

- Couples Budget Planner: A paper planner that includes monthly budget sheets and goal-setting pages. Perfect for those who prefer writing things down.

- YNAB (You Need a Budget): Known for its powerful features and educational resources, YNAB helps couples build strong budgeting habits.

Choosing a budget planner is a personal decision. Think about what will work best for you and your partner. Do you need something simple or more comprehensive? Are you looking for digital convenience or the tactile feel of paper? Take your time and try different options. The right budget planner can make managing your finances together not only easier but also enjoyable.

Creating A Shared Budget

Creating a shared budget can strengthen a couple’s financial health. It helps align financial goals and ensure transparency. This guide on the best budget planner for couples will help you understand how to combine incomes and allocate expenses effectively.

Combining Incomes

Start by listing all sources of income. Include salaries, freelance work, and any passive income. Make sure to combine these incomes to get a clear picture of your total funds. Next, discuss how to pool these resources. Decide on a joint account or keep separate accounts with shared access. Agree on a system that works for both partners. Transparency is key to avoid misunderstandings.

Allocating Expenses

List all monthly expenses. Include rent, utilities, groceries, and entertainment. This gives a clear view of your outgoings. Assign a specific amount to each category. Prioritize essential expenses first. Set aside money for savings and emergencies. This ensures financial stability. Discuss and agree on discretionary spending. Allow flexibility for personal purchases. This helps in maintaining harmony and mutual respect. Review and adjust the budget regularly. Track expenses to avoid overspending. Make changes as needed to stay on track. This process helps in meeting shared financial goals.

Tracking Expenses As A Team

Managing finances together can strengthen relationships. A shared budget planner helps couples track expenses, set goals, and stay on the same page. Enjoy financial harmony with the best tools designed for teamwork.

Tracking expenses as a team can significantly enhance financial harmony in your relationship. When you and your partner are on the same page about where your money is going, it can reduce stress and improve your savings. Working together on a budget planner ensures accountability and fosters trust.

Using Apps And Tools

Modern technology offers various apps and tools that can simplify expense tracking. Apps like Mint, YNAB (You Need A Budget), and Honeydue are popular for couples. These apps allow you to link bank accounts, set budgets, and track spending in real-time. Using these tools can make it easier to categorize expenses and see where adjustments are needed. You can set up notifications for when you are close to budget limits, ensuring no surprises at the end of the month. An app can streamline the process and reduce the effort needed to keep your budget updated.

Regular Check-ins

Scheduling regular financial check-ins is vital. Consider setting a weekly or bi-weekly meeting to review your expenses and adjust your budget as needed. These meetings should be short and focused, making them less daunting. During your check-ins, celebrate small wins like staying under budget or saving more than planned. Address any overspending issues without blaming each other. The goal is to keep each other informed and work as a team towards your financial goals. Have you found a specific tool or strategy that works best for you and your partner in tracking expenses? Share your experiences and tips in the comments below!

Handling Unexpected Expenses

Handling unexpected expenses is crucial for couples managing a budget. These expenses can disrupt your financial plan. Proper preparation helps you stay on track. Planning for surprises together can strengthen your financial stability.

Emergency Funds

An emergency fund acts as a financial cushion. Couples should save three to six months of expenses. This fund covers unexpected events like medical bills or car repairs. Start small if saving seems hard. Even small contributions add up over time. Open a separate account for emergencies. This keeps the funds safe and distinct. Avoid using this money for regular expenses. Discipline is key to maintaining this fund. Review your savings goals regularly. Ensure you both contribute consistently.

Adjusting The Budget

Unexpected expenses might require budget adjustments. First, identify non-essential expenses. Cut back on dining out or entertainment. Redirect this money towards the unexpected cost. This helps manage the expense without derailing your budget. Communicate openly about financial changes. Work together to reallocate funds. Consider temporary adjustments. Once the expense is covered, review your budget again. Ensure it aligns with your financial goals. Staying flexible is important. Regularly revisit your budget. Make adjustments as needed. This keeps your finances balanced and prepared for surprises.

Saving And Investing Together

Couples can manage finances effortlessly with the best budget planner. Track expenses, set savings goals, and invest smartly together. Strengthen your financial future as a team.

Saving and investing together can strengthen a couple’s financial future. It builds trust and ensures both partners work towards common goals. By planning together, couples can manage their finances more effectively and make informed decisions.

Building Savings

Start by setting clear savings goals. Discuss what you both want to save for. It could be a vacation, a new home, or a rainy day fund. Decide how much you need to save monthly to reach these goals. Use a joint account for easier tracking. Automate savings transfers to avoid missing contributions. Celebrate small milestones to stay motivated. This makes saving feel rewarding.

Joint Investment Strategies

Investing together can grow your wealth faster. Begin by understanding each other’s risk tolerance. Choose investments that match your comfort levels. Diversify to reduce risks. Consider stocks, bonds, and mutual funds. Regularly review your investments. Adjust your strategies as needed. Stay informed about market trends. Seek advice from financial advisors if necessary. Working together on investments strengthens your financial partnership.

Credit: create.microsoft.com

Communicating About Money

Discover the best budget planner for couples to manage finances together. Improve communication about money and achieve shared goals. Simplify your financial planning today.

## Communicating About Money Talking about money with your partner can be challenging, but it’s crucial for a healthy relationship. Open communication ensures you both understand each other’s financial goals and concerns. Budget planning becomes smoother when both partners are on the same page. ###

Effective Communication Tips

Start with honesty and transparency. Share your financial history, including debts and credit scores. This builds trust and sets a foundation for joint financial planning. Schedule regular money talks. This keeps you both updated on your financial status and helps address any issues promptly. Choose a time when you’re both relaxed and free of distractions. Use “we” statements instead of “you” statements. This fosters a sense of teamwork and avoids blame. For example, say “We need to save more” instead of “You need to stop spending so much.” ###

Resolving Money Disagreements

Disagreements about money are common, but they don’t have to be destructive. Approach conflicts with a problem-solving mindset. Focus on finding a solution rather than proving who’s right. Set financial goals together. This helps align your spending and saving habits. Goals give you both something to work towards and can reduce friction over money matters. Take turns listening to each other’s viewpoints. Make sure both partners feel heard and respected. This can defuse tension and lead to compromises that satisfy both parties. Have a designated “cooling-off” period for heated discussions. Sometimes, stepping away for a bit can help you return to the conversation with a clearer head. By following these tips, you can make budgeting a collaborative and positive experience. How do you and your partner approach money talks? Share your experiences in the comments below!

Credit: www.theknot.com

Frequently Asked Questions

What Is The Best Budgeting App For 2 People?

The best budgeting app for two people is You Need A Budget (YNAB). It offers real-time syncing and sharing, helping couples manage finances together.

What Is The 50 30 20 Rule For Couples?

The 50 30 20 rule for couples suggests allocating 50% of income to needs, 30% to wants, and 20% to savings.

What Is The Best Way To Track Finances As A Couple?

The best way to track finances as a couple is to use a shared budgeting app. Regularly review expenses together and set clear financial goals. Communicate openly about spending and saving habits. This helps maintain transparency and ensures both partners are on the same page financially.

What Is A Realistic Budget For A Couple?

A realistic budget for a couple typically ranges from $3,000 to $5,000 per month, depending on location and lifestyle choices.

Conclusion

Choosing the best budget planner for couples is essential. It simplifies money management. Couples can reach their financial goals together. This planner promotes clear communication. It helps avoid misunderstandings. Easy budgeting reduces stress. Stronger relationships often result. Consider your needs and preferences.

Then select the right planner. Start budgeting today. Enjoy a more secure future together.